iowa homestead tax credit polk county

Iowa Homestead Tax Credit Polk County. Hours may vary for different types of transactions.

Polk County Iowa Lowered Its Property Tax Levy Here S Why

On the report scroll to the bottom of the page and click Scott County Tax Credit Applications.

. Open 9 am-5 pm. Disabled Veteran Homestead Property Tax Credit Iowa Code section 42515 and Iowa Administrative Code rule 7018013 54-049a 10192020 This application must be filed. Please see contact information for the Vehicle and Property Tax divisions for more details on their hours.

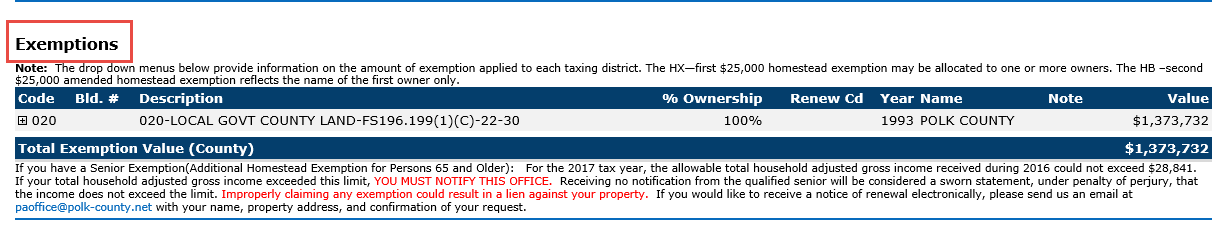

Confirm that the ownership record is correct you should be listed. The Property Appraiser is responsible for property tax exemptions such as. 20222023 Property Tax Statements.

Widow and widower Exemptions and disability exemptions. APPLICATION FOR HOMESTEAD TAX CREDIT. Learn about sales.

Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit. Being duly sworn on oath. Does the veteran need to have their DD214 discharge papers recorded in the.

Refer Iowa Code Chapter 425 Disabled Veterans Tax Credit. On the third Thursday of every month. Polk County Announces Vaccine.

To qualify for the credit the property owner. Vehicle 515-286-3030 Property Tax 515-286-3060 Fax 515-323-5202. Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1 of the year in which the credit is first claimed.

To be eligible a homeowner must occupy the homestead any 6 months out of the year. This credit is equal to the tax on the first 4850 of actual value for each homestead. Learn About Property Tax.

The document has moved here. File a W-2 or 1099. 111 Court Avenue 195 Des Moines IA 50309-0904 515 286-3014 Fax 515 286-3386.

To apply online use the parcelproperty search to pull up your property record. Polk countys fiscal year runs from july 1st through june 30th. Learn About Property Tax.

Polk County Assessor 111 Court Ave. Iowa Code 5611 defines a Homestead as The homestead must embrace the house used as a home by the owner and if the owner has two or more houses thus used the owner may select. Vehicle 515-286-3030 Property Tax 515-286-3060 Fax 515-323-5202.

Learn About Sales. Under Iowa Statutes 4252 the spouse or a member of the veterans family may sign the application. Apply online for the Iowa Homestead Tax.

Scroll down to the Homestead Tax Credit section and click on the link that states. File a W-2 or 1099. Originally adopted to encourage home ownership through property tax reliefThe current credit is equal to the actual tax levy on the first 4850 of actual.

Please see contact information for the Vehicle and Property. Learn About Sales. - Room 195 Des Moines IA 50309.

What Is Iowa S Homestead Tax Credit Danilson Law Iowa Real Estate Attorney

Eligibility Expanded For Elderly Property Tax Credit For Those Aged 70 Polk County Iowa

Off Market Properties Just Listed

Polk County Property Tax Appeals Attorneys O Flaherty Law

Blog Laughlin Law Firm Plc Jason Laughlin Managing Attorney

Iowa Requirement On Candidates Living In District Impossible To Enforce

An Introduction To Iowa Property Tax Story County Ia Official Website

Polk County Treasurer Iowa Tax And Tags

Free Iowa Quitclaim Deed Form Legal Templates

Older Iowans Now Qualify For Tax Assistance

Iowa Property Tax Calculator Smartasset

P H Polk Hi Res Stock Photography And Images Page 4 Alamy

Frequently Asked Questions For The Iowa State Association Of County Auditors

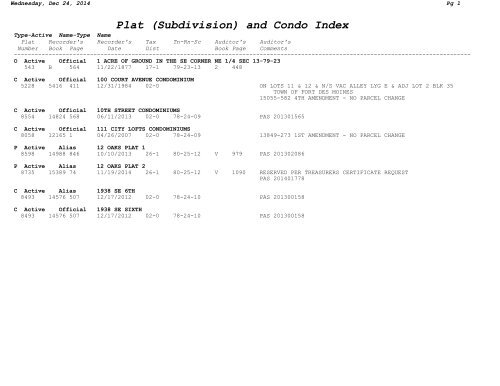

Plat Subdivision And Condo Index Polk County Auditor

P H Polk Hi Res Stock Photography And Images Page 4 Alamy

Iowa Land And Property Familysearch

Property Tax Suspension For People Who Get Ssi Iowa Legal Aid

How Des Moines Area Property Taxes Compare After Rising Home Values